Crystal Fund to Present on AI and Innovation in CLO Technology at Opal Group European CLO SummitSeptember 29, 2025

Dublin – September 29, 2025 – Crystal Fund is pleased to announce its participation in the prestigious Opal Group European CLO Summit, scheduled for October 7th in London.

Pierre-Olivier Fortin from Crystal Fund will join a high-profile industry panel titled “Utilizing CLO Technology: Innovation & Integration,” focusing on the critical role of technology in enhancing efficiency and driving returns within the Collateralized Loan Obligation (CLO) market.

During the session, Dr. Fortin will share practical insights into how we are successfully leveraging Artificial Intelligence (AI) models to optimize our trading strategies. The discussion will cover the deployment of these tools for advanced data analysis and identifying high-alpha trading opportunities within the complex structured credit landscape. His participation will underscore the firm’s commitment to adopting cutting-edge technology to maintain a competitive edge.

The panel features esteemed industry experts, including Daniel Ezra, Laura Noble, Natalia Esipenko, and Peter Jasko. Maximilian Grimm will moderate the discussion from Opal Group.

We look forward to exchanging ideas with fellow leaders on the transformative power of technological innovation in structured credit and addressing the future challenges and opportunities within the European CLO ecosystem.

9fin Article featuring the Crystal FundAugust 12, 2025

We are glad to share with you an article from 9fin featuring comments from Olivier Gozlan, portfolio manager at Crystal Fund.

CLOs overcome April showers with rapid recovery — Q2 25 CLO fund returns (9fin) |

|

*No exit fees on fund **Structured as closed-end funds †Fund has quarterly NAV/liquidity broken down into monthly returns ††Fund has at least some marked to model component. All returns net of fees. Some March returns include estimates. For a download of returns please click here. CLO fund performance demonstrated resilience in Q2 2025, marked by a drop-off in April swiftly followed by a strong recovery. CLO funds that target equity, for example, posted an average of -2.16% in April, but ended the quarter with average returns of 2.04% across the whole period. Both primary and secondary CLO markets have been active. Despite tariff turbulence, the US BSL market brought $87.4bn of pricings in Q2, down less than a fifth from the same period in 2024 (a record year), in which there was $107bn of primary activity. And in Europe, despite a pause in the market for most of April, there were €20.6bn of pricings, up from €18.2bn in the 2024 period. Despite initial volatility and spread widening after ‘Liberation Day’ (2 April), spreads across the cap stack tightened in the latter half of the quarter, although senior tranches lagged. European CLO triple-As are now seen as attractive compared to US BSL CLO triple-As on a rate and currency-hedged basis, with rising interest from Japanese investors, according to sources. There has also been strong secondary CLO market activity. According to Citi CLO research, European CLO IG BWIC volumes were up 10% year-on-year at €4.5bn, although non-IG and equity volumes have dropped 28% year-on-year, to €2bn. CLO DNT rates spiked to 16% for IG (versus 7% LTM average) and 19% (16%) for non-IG during Liberation Day, as the market entered a price discovery mode. In a wider view, the CLO market remains attractive versus other ABS products. According to Citi Research, CLO triple-As offer a 53bps spread pickup over Dutch Prime triple-As and a 26bps spread pickup over UK Prime triple-As. CLO triple-Bs are also offering attractive spread pick-ups to double-B rated high yield, with double-B rated loans trading 15bps wider than CLOs at the end of June. Post Liberation DayAs already hinted, the tariff-induced volatility immediately following Liberation Day had an impact on CLOs as it did the rest of the financial market, although there were also opportunities for canny CLO investors. Nishil Mehta, head of structured credit investments at Carlyle Group, told 9fin his firm capitalised on post-Liberation Day volatility by opportunistically buying CLO double-B tranches in the secondary market at discounted prices. These positions rallied to par over the quarter. “While relative value between primary and secondary markets shifted as the market rallied, we continue to actively assess relative value,” he explained. “We increased exposure to European CLO double-Bs as they offer a healthy spread pickup versus similar profile US CLO double-Bs. We believe the spread pickup is adequately compensating investors for decreased liquidity in the European market.” Ron Zeltzer, portfolio manager at Valeur Group, said the firm executed five primary trades in June, all in single-B tranches, which now account for 12% of the portfolio, up from zero the previous month. “These new positions now offer yields around 11%, backed by clean collateral and strong structural protection,” he said. “At the same time, we exited a legacy double-B position with limited upside. Elevated spreads in single-Bs, driven by shallow investor depth and an outsized share of new supply, created compelling relative value. These trades boosted our portfolio yield, with only a modest increase in duration.” While post-Liberation Day opportunities may have been short-lived, some managers found supply through fund liquidations. “Liquidations of a couple of closed-ended funds have helped in terms of supply, either via BWIC or bilaterally,” said one CLO investor. “One manager started selling in February, a little bit in March, but then stopped and has now started again. We’re not talking about selling at distressed prices.” The CLO ETF market also held firm despite volatility. “There was previously concern that large ETFs might amplify volatility, but there was always a buyer. It wasn’t messy,” a mezzanine investor noted. “Of course, there was some price movement, but compared to other situations, it was orderly. The market digested it well, with no major forced selling or drama.” Meanwhile, the European CLO ETF space continued to grow, intensifying competition. BlackRock expanded its platform with the launch of the iShares € and $ AAA CLO Active UCITS ETFs, both focused on triple-A CLO tranches. Following this, Invescoannounced a fee reduction on its CLO UCITS ETFs — from 0.35% to 0.25% annually, effective 24 July 2025. Similarly, the Janus Henderson Tabula EUR AAA CLO UCITS ETF also appears to have cut its annual fee to 0.25%. This evolving landscape has also raised the possibility of CLO ETFs looking further afield in Europe. “The recent mezzanine tightening in euro CLOs stems from investors scrutinizing the primary equity arbitrage,” one investor said. “We’re seeing growing ETF demand lower down the capital stack, not just in triple-As.” Positioning for H2The picture looks a lot rosier now for CLOs than it did in April, but questions on arbitrage, spread tightening and a potential re-emergence of macro volatility remain. Olivier Gozlan, portfolio manager at Crystal Funds, emphasised that, while short-term performance is favourable, current discount margins are at all-time tight levels, indicating potential risks ahead. “When you look at the last 5-10 years of historical discount margins, it’s clear that we’re currently at an all-time tight. In terms of short-term performance, the market is favorable, allowing for decent trading and returns.” “However, when thinking about the next cycle, it’s important to position your portfolio not just for short-term gains, but also for medium-term performance,” added Gozlan. “Given that spreads are currently tight, we need to be prepared for potential widening.” For firms sensitive to mark-to-market fluctuations, Gozlan says it’s crucial to choose tranches that will be less impacted by price movements. “One way to partially hedge against volatility is by buying high-coupon tranches, as they tend to be less sensitive to market fluctuations and offer more stability,” he said. “We’ve employed this strategy for various reasons. A major opportunity we saw in the first half of the year was in short-duration paper, which is typically high-coupon and much less vulnerable to spread widening.” Despite these active strategies, some investors remain cautious, particularly those looking to build cash reserves. “Right now feels like time to have a little more cash, and wait and see what kind of supply picture forms in September, what the fundamentals are doing, what the macro is doing,” said an investor. Refinancing and reset activity continues to be a major theme in the CLO market. In Europe, Citi CLO Research maintained its €50bn refi/reset target for the year, estimating €50bn of European CLOs will be in the money to either refi or reset by the end of 2025. This is especially true for the 2023 vintage, where half of those deals are expected to be reset or refinanced. Some investors are opting to bypass resets amid relative value. “Managers have reset deals and managed to get very tight spreads,” said another investor. “We need arbitrage, so most of the times, it has made more sense to not participate in resets and buy in the secondary market where you can find wider spreads.” Shifting landscapesMehta anticipates further tightening in loan spreads, although repricing activity has moderated over Q2. He also highlighted the potential risks from tariffs, noting that, while the direct impact on the loan market is limited, about 5-10% of borrowers have medium-to-high tariff exposure. “We are more focused on the indirect impacts of tariffs, and the implications of how a broader slowdown in the global economy could stress borrowers that are already struggling or over-levered. In this situation, we would anticipate a potential increase in loan downgrades and defaults,” he said. By the end of the quarter downgrades were off the peaks seen in 2024, but they still outpaced upgrades, and average triple-C buckets for reinvesting CLOs stood at 4.5% and 3.8%, for US and Europe, respectively, according to data from 9fin and Moody’s Analytics. Sources also indicate possible volatility due to shifting regulatory landscapes, geopolitical tensions, and uncertainty around the Fed’s policy decisions. Based on the outlook for volatility in the second half of the year, Mehta says the firm has defensively positioned its portfolios to allow them to be more aggressive in periods of volatility, similar to what they did following Liberation Day. Despite the potential for near-term volatility, he believes CLO debt spreads could tighten further, though they will remain attractive compared to investment-grade and high-yield bonds. Typically, there is often portfolio rebalancing in September and December, which could also lead to volatility. However, Gozlan says he does not foresee any major catalysts for large spread or price changes in the second half of the year. “Looking ahead to 2026, we might see more movement, especially with the anticipated weakening of the dollar, which is one of the goals of the US government. There could also be volatility tied to the transition of the Fed’s leadership and changes in policy. And of course, the ongoing geopolitical situation adds another layer of uncertainty. So, while we don’t expect significant changes in the short term, medium-term volatility and potential spread widening are more likely as we approach 2026.” In terms of regulatory updates to keep an eye on, Basel III, and the anticipated changes in risk-weighted asset (RWA) requirements, reducing CLO triple-A RWAs from 20% to 15%, could provide support for US banks to invest in CLOs. “There’s the continued monitoring of US insurer capital treatment under the NAIC, potential reductions in capital requirements for banks, and the impact of evolving European risk retention rules, which have hindered some US market resets,” says Mehta. |

Introducing the Crystal Fund VideoJune 23, 2025

We’re pleased to share a short video in which Olivier Gozlan and Pierre-Olivier Fortin, introduce the Crystal Fund, our CLO investment strategy designed for professional investors.

The video shares the story behind Crystal — a name that reflects our origins as investors first. This perspective shapes everything we do:

– Rigorous, bottom-up credit selection

– Clear ESG exclusions (Article 8 SFDR)

– Transparent, opportunity-driven portfolio construction

If you’re seeking differentiated access to the CLO market that aligns strongly with investor interests, we’d be glad to continue the conversation.

Watch the video here:

Launch: Two new CLO funds in BK seriesApril 1, 2025

Crystal Fund is preparing to launch the following two funds in its BK Funds CLO series, each designed with a distinct investment approach.

The first, BK Opportunities Fund 9, is expected to launch as a closed-ended vehicle investing across both U.S. and European CLOs in April. With a flexible mandate spanning triple-Bs through to equity, the fund will target an average double-B rating. In response to ongoing market volatility, the portfolio will emphasize short-duration instruments, providing room to adjust positioning if spreads shift significantly. Both cumulative and distribution share classes will be available.

Following Fund 9, Crystal Fund is planning the launch of BK Investment Grade 10, an open-ended vehicle expected to focus on investment-grade CLO tranches with an average single-A rating.

These launches follow the strong performance of BK Opportunities Fund 8, Crystal’s vehicle to combine exposure to U.S. and European CLOs within a single structure. That fund returned 13.2% since inception, while maintaining an investment-grade profile.

BK Opportunities Fund 7, launched in 2021, remains in its reinvestment period and has delivered an annual return of 15% since inception.

Crystal Fund continues to expand the BK series with differentiated approaches to CLO investing, tailored to a range of risk profiles and market environments.

2024 CLO fund returns (9fin)January 31, 2025

We are glad to share a section of the 9fin article on the 2024 CLO fund returns. We are proud of the performance of our three live funds as they are all top performer in their respective category investment grade for BK-8, Mezzanine for BK-6, and BK-7.

*No exit fees on fund **Structured as closed-end funds †Fund has quarterly NAV/liquidity broken down into monthly returns ††Fund has at least some marked to model component. All returns net of fees. Some December returns include estimates.

For a full breakdown of returns please click here.

Crystal Fund Wins Best CLO Fund Award at Creditflux Manager Awards 2024May 22, 2024

We are thrilled to announce that the Crystal Fund has been honored with the Best CLO Fund Award at the prestigious Creditflux Manager Awards 2024!

This significant achievement reflects our unwavering commitment to excellence and innovation. We are incredibly proud of this accomplishment and deeply grateful for the trust and support of our investors and partners.

Thank you for being an integral part of our journey and success.

CLO funds start 2024 on positive note (9fin)May 12, 2024

Sam Robinson | sam.robinson@9fin.com and Michelle D’souza | michelle@9fin.com

CLO funds followed up an impressive 2023 with a strong Q1 this year, 9fin data shows. Of the 36 CLO funds listed in the 9fin dataset, none reported a month of negative returns in the first quarter of 2024.

In total, funds in our database averaged cumulative returns of 5.2% across the quarter, with funds that had the flexibility to invest in both mezz and equity returning the highest average of 6.18%.

CLO amortisation and redemptions were one of the main themes of Q1, with eight European CLOs and 39 US CLOs liquidated via BWIC in Q1, according to 9fin data, indicating many equity investors were happy to cash out on CLOs, with loan levels rising and liabilities amortising.

One of the chief headline-generators at the back end of Q1 was the downgrade of Altice France by Moody’s and S&P. 9fin reported at the time that the downgrade alone was unlikely to be massively disruptive to the health of most CLOs, and CLOs exited Q1 with low triple-C buckets in Europe. Even in the US rising triple-C levels have yet to lead to significant par test breaches.

*No exit fees on fund **Structured as closed-end drawdown funds †Fund has quarterly NAV/liquidity broken down into monthly returns ††Fund has at least some marked to model component.

For a full breakdown of fund returns please click here.

US CLO performance

After facing tough arbitrage levels throughout 2023, CLO equity investors have enjoyed a strong start to the year.

“When you hear about this many deals being called, refinanced or reset, it means it’s probably going to be a gangbuster year for equity,” said Jay Huang, head of structured credit investments for CIFC Asset Management, “because people only exercise these options if they’re highly accretive versus holding the equity.”

Most of the positions in CIFC’s portfolio are out of non-call, said Huang, which is key for an environment like this, where it’s vital to have exerciseable options.

“Last year the main opportunities were in secondary mezz”, said Huang, “When double-Bs are trading in the 50-70s, that had a better risk return profile than any equity we saw in the market, but in Q1 2024, the convexity upside shifted to the equity in the secondary market.”

Primary equity has begun to regain some of its appeal, however, with 9fin reporting in March that third party equity investors were starting to make a return to the market.

Huang said CIFC is among those CLO equity investors that has started to come back to the primary market over the past couple of months, “where we’ve closed a few, for the first time since the first half of 2022”.

CIFC’s three listed funds, two in harvest mode and CIFC Opportunity Fund V, which launched last year, returned 6.15%, 8.11% and 9.59% in the first quarter of this year.

The trend looks set to extend in April, with Q2 equity payments largely in and positive. 9fin reported that BofA research showed early US CLO equity payments for April had reached an eight-year peak.

European CLO performance

European CLOs also enjoyed a strong start to the year, with Deutsche Bank research showing European CLO NAVs ended the quarter at 44%, which was up 2.3% from the start of the year.

JP Morgan’s €-CLOIE index showed that European CLO debt had also performed well, with triple-As gaining 1.86% year-to-date (compared to 1.61% for EY HY Corporates) with JP Morgan noting, “€-CLOIE has outperformed $-CLOIE from AAAs to BBs as price gains in European CLOs offset marginally higher coupons provided by US CLOs.”

BK Opportunities Fund-VII, from Crystal Fund, had the highest cumulative Q1 returns, adding 10.41% in the quarter. That fund launched in September 2021 and has made annualised 16.3% returns since inception, according to 9fin data. The fund invests in European CLO mezz tranches.

Supply was strong throughout Q1, with analysts at BofA and Deutsche Bank among others revising upwards their projections for 2024. European CLO performance was also helped by spread tightening.

Triple-As ended the quarter having tightened around 15-20bps into the high E+140bps to E+150bps area. This tightened further in April with Palmer Square setting the European benchmark at E+145bps.

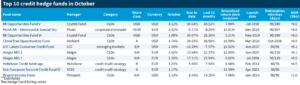

BK Opportunities V is Top Performing Credit Strategy hedge funds in 2024 by PreqinApril 10, 2024

We are thrilled to announce that BK Opportunities V has been recognized as one of the Top Performing Credit Strategy hedge funds in 2024 by Preqin!

We are truly honored to be acknowledged for our dedication, expertise, and outstanding performance in the credit strategy space. This achievement reflects our talented team’s hard work and commitment and the trust and support of our valued investors. Given the challenging market conditions, it’s a testament to our team’s resilience, expertise, and unwavering dedication to success.

We sincerely thank our investors, partners, and team members for their continued support and dedication.

Thank you, Preqin, for this incredible recognition, and thank you to everyone who has been a part of our journey!

CLOs Sales Forecasts Jump Amid Heavy Issuance: Structured WeeklyMarch 25, 2024

By Scott Carpenter

(Bloomberg) — Collateralized loan obligations are seeing a surge in sales volume, spurring strategists to boost their issuance expectations for the year. Strategists at Citigroup Inc. and Barclays Plc have in recent weeks raised their forecasts for new US CLO volume this year, with Barclays lifting its forecast for securities backed by broadly syndicated loans by at least 50%. And analysts at both Morgan Stanley and Nomura have said that CLO equity, the riskiest part of the transactions, now looks compelling, according to research notes from the firms.

The CLO market is benefiting from a rally that’s gripped credit markets broadly as investors grow increasingly hopeful that the Federal Reserve will help the economy avoid recession despite a series of rate hikes that started in 2022. Amid this rally, the CLO arbitrage has improved, signaling more profit can be earned from managing CLOs, Citigroup said in its note.

Although there are still questions about when the Fed will make its first interest-rate cut, the market is taking solace in the fact that rates will probably stay higher for longer. What’s more, despite the highest interest rates in years, default rates for leveraged loans remain below their historical averages, a surprising development that’s helped boost demand for CLOs, said Olivier Gozlan, an investment manager at Crystal Fund, a family of investment vehicles managed by Oristan Ireland DAC. “There’s been a huge shift in the market’s view of CLOs over the last few months,” Gozlan said. “It’s much more bullish.”

Of course, it’s still too early to say how well the leveraged loan market will handle today’s elevated interest rates. Gozlan isn’t overly optimistic about the CLO market’s ability to absorb additional stress in coming months. “It’s difficult for me to be convinced that interest rates for many companies can double and you can have little damage from that,” he said. Elsewhere in credit markets, robust investor demand for bonds has kept risk premiums relatively tight despite ample supply of newly issued debt, while spreads on junk bonds dropped to their narrowest levels since early 2022. A Bank of America strategist said last week that high-grade bonds are experiencing a “goldilocks scenario” of higher yields, lower interest-rate volatility, fund inflows and “hot, but not too hot US data.”

9finFebruary 21, 2024

We want to welcome a new name in the debt market news, 9fin!

We are also delighted to be featured in their article “CLO hedge funds return over 20% on average in 2023”. It is an excellent summary of the 2023 performance for CLO funds; see the performance table (here). We share with you an extract from this article:

Crystal Funds’ portfolio manager Olivier Gozlan said tightening at the end of the fourth quarter of 2023 from a mark-to-market point of view accounted for around 60% of his funds’ strategies’ performance. CLO resets of large positions in 2023 also contributed, Gozlan added.

“When the war in Ukraine started in 2022, many people thought the crisis would be a matter of weeks but by May/June the market realised it was going to be for a long time,” he said. “There was a wave of new deals in the summer being issued for risk management of the warehouse with debt issued at a large spread and we raised money at the time for this specific opportunity.”

Gozlan says the firm was able to deploy at this efficient entry point, for example investing in single-Bs in the 1,500 DM. “Today spreads are 900bp, so the price effect is material,” he added.

The full article can be found (here).

Leading Fund – BK Opportunities Fund VFebruary 15, 2024

We are delighted that CreditFlux has written an article in the January edition of their newsletter on BK Opportunities Fund V as a leading credit fund for its outstanding return.

You can find the full article (here).

Creditflux CLO Symposium 2023 Panel with Olivier GozlanMay 10, 2023

During the Creditflux CLO Symposium 2023, Olivier Gozlan, portfolio manager at Crystal Fund, participated in the Panel: Would you buy it?

You can access the entire panel discussion here.

Crystal Fund receives Best CLO Fund award in 2023 at CreditFlux Award CeremonyMay 4, 2023

Launch of BK Investment Grade VIIIApril 1, 2023

Crystal Fund is expanding with a new strategy focused on global investment-grade CLO tranches. Up to now, the focus was on junior mezzanine in US and European CLO tranches alongside CLO equity. The extension of investment scope comes from identifying meaningful risk-return opportunities in the single As and triple Bs.

BK Investment Grade VIII will launch at the end of April 2023, giving Crystal Fund the ability to invest from single As down to equity.

Dr Pierre-Olivier Fortin is promoted to the investment committeeMarch 15, 2023

The Crystal Fund keeps developing. The strategy leans toward business growth and responsible investment. As part of this strategy, the investment committee welcomes Dr Pierre-Olivier Fortin to join and bring a new set of expertise to assist the investment decisions.

Signatory of the Principles for Responsible InvestmentMarch 1, 2023

The Crystal Fund seeks to participate in building a more sustainable financial system. We believe the credit market as a whole, and the CLO market in particular, can be sustainable and act as welfare-enhancing.

This is why on March 2023, the crystal fund and all its associated vehicles signed the Principles for Responsible Investment (PRI) to show the Crystal Fund’s commitment to responsible investment.

Launch of BK-7September 15, 2021

In September 2021, the crystal fund launched its new investment vehicle, BK-7. It is composed of two euros CLO mezzanine tranches.

CLO Mezz Panel – CLO Summit with Olivier GozlanDecember 9, 2020

Olivier Gozlan, portfolio manager at Crystal Fund, participated in the CLO Mezz Panel – CLO Summit.

Crystal Fund receives Best CLO Fund award in 2019 at CreditFlux Award CeremonyMay 7, 2019

On May 7th, 2019, Olivier Gozlan from Oristan DAC was awarded the prestigious best CLO Fund at the CreditFlux Award Ceremony of the CLO Symposium in London. We have a short video of Olivier Gozlan accepting this award.