Crystal Fund Wins Best CLO Fund Award at Creditflux Manager Awards 2024May 22, 2024

CLO funds start 2024 on positive note (9fin)May 12, 2024

Sam Robinson | sam.robinson@9fin.com and Michelle D’souza | michelle@9fin.com

CLO funds followed up an impressive 2023 with a strong Q1 this year, 9fin data shows. Of the 36 CLO funds listed in the 9fin dataset, none reported a month of negative returns in the first quarter of 2024.

In total, funds in our database averaged cumulative returns of 5.2% across the quarter, with funds that had the flexibility to invest in both mezz and equity returning the highest average of 6.18%.

CLO amortisation and redemptions were one of the main themes of Q1, with eight European CLOs and 39 US CLOs liquidated via BWIC in Q1, according to 9fin data, indicating many equity investors were happy to cash out on CLOs, with loan levels rising and liabilities amortising.

One of the chief headline-generators at the back end of Q1 was the downgrade of Altice France by Moody’s and S&P. 9fin reported at the time that the downgrade alone was unlikely to be massively disruptive to the health of most CLOs, and CLOs exited Q1 with low triple-C buckets in Europe. Even in the US rising triple-C levels have yet to lead to significant par test breaches.

*No exit fees on fund **Structured as closed-end drawdown funds †Fund has quarterly NAV/liquidity broken down into monthly returns ††Fund has at least some marked to model component.

For a full breakdown of fund returns please click here.

US CLO performance

After facing tough arbitrage levels throughout 2023, CLO equity investors have enjoyed a strong start to the year.

“When you hear about this many deals being called, refinanced or reset, it means it’s probably going to be a gangbuster year for equity,” said Jay Huang, head of structured credit investments for CIFC Asset Management, “because people only exercise these options if they’re highly accretive versus holding the equity.”

Most of the positions in CIFC’s portfolio are out of non-call, said Huang, which is key for an environment like this, where it’s vital to have exerciseable options.

“Last year the main opportunities were in secondary mezz”, said Huang, “When double-Bs are trading in the 50-70s, that had a better risk return profile than any equity we saw in the market, but in Q1 2024, the convexity upside shifted to the equity in the secondary market.”

Primary equity has begun to regain some of its appeal, however, with 9fin reporting in March that third party equity investors were starting to make a return to the market.

Huang said CIFC is among those CLO equity investors that has started to come back to the primary market over the past couple of months, “where we’ve closed a few, for the first time since the first half of 2022”.

CIFC’s three listed funds, two in harvest mode and CIFC Opportunity Fund V, which launched last year, returned 6.15%, 8.11% and 9.59% in the first quarter of this year.

The trend looks set to extend in April, with Q2 equity payments largely in and positive. 9fin reported that BofA research showed early US CLO equity payments for April had reached an eight-year peak.

European CLO performance

European CLOs also enjoyed a strong start to the year, with Deutsche Bank research showing European CLO NAVs ended the quarter at 44%, which was up 2.3% from the start of the year.

JP Morgan’s €-CLOIE index showed that European CLO debt had also performed well, with triple-As gaining 1.86% year-to-date (compared to 1.61% for EY HY Corporates) with JP Morgan noting, “€-CLOIE has outperformed $-CLOIE from AAAs to BBs as price gains in European CLOs offset marginally higher coupons provided by US CLOs.”

BK Opportunities Fund-VII, from Crystal Fund, had the highest cumulative Q1 returns, adding 10.41% in the quarter. That fund launched in September 2021 and has made annualised 16.3% returns since inception, according to 9fin data. The fund invests in European CLO mezz tranches.

Supply was strong throughout Q1, with analysts at BofA and Deutsche Bank among others revising upwards their projections for 2024. European CLO performance was also helped by spread tightening.

Triple-As ended the quarter having tightened around 15-20bps into the high E+140bps to E+150bps area. This tightened further in April with Palmer Square setting the European benchmark at E+145bps.

BK Opportunities V is Top Performing Credit Strategy hedge funds in 2024 by PreqinApril 10, 2024

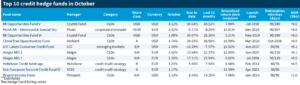

We are thrilled to announce that BK Opportunities V has been recognized as one of the Top Performing Credit Strategy hedge funds in 2024 by Preqin!

We are truly honored to be acknowledged for our dedication, expertise, and outstanding performance in the credit strategy space. This achievement reflects our talented team’s hard work and commitment and the trust and support of our valued investors. Given the challenging market conditions, it’s a testament to our team’s resilience, expertise, and unwavering dedication to success.

We sincerely thank our investors, partners, and team members for their continued support and dedication.

Thank you, Preqin, for this incredible recognition, and thank you to everyone who has been a part of our journey!

CLOs Sales Forecasts Jump Amid Heavy Issuance: Structured WeeklyMarch 25, 2024

By Scott Carpenter

(Bloomberg) — Collateralized loan obligations are seeing a surge in sales volume, spurring strategists to boost their issuance expectations for the year. Strategists at Citigroup Inc. and Barclays Plc have in recent weeks raised their forecasts for new US CLO volume this year, with Barclays lifting its forecast for securities backed by broadly syndicated loans by at least 50%. And analysts at both Morgan Stanley and Nomura have said that CLO equity, the riskiest part of the transactions, now looks compelling, according to research notes from the firms.

The CLO market is benefiting from a rally that’s gripped credit markets broadly as investors grow increasingly hopeful that the Federal Reserve will help the economy avoid recession despite a series of rate hikes that started in 2022. Amid this rally, the CLO arbitrage has improved, signaling more profit can be earned from managing CLOs, Citigroup said in its note.

Although there are still questions about when the Fed will make its first interest-rate cut, the market is taking solace in the fact that rates will probably stay higher for longer. What’s more, despite the highest interest rates in years, default rates for leveraged loans remain below their historical averages, a surprising development that’s helped boost demand for CLOs, said Olivier Gozlan, an investment manager at Crystal Fund, a family of investment vehicles managed by Oristan Ireland DAC. “There’s been a huge shift in the market’s view of CLOs over the last few months,” Gozlan said. “It’s much more bullish.”

Of course, it’s still too early to say how well the leveraged loan market will handle today’s elevated interest rates. Gozlan isn’t overly optimistic about the CLO market’s ability to absorb additional stress in coming months. “It’s difficult for me to be convinced that interest rates for many companies can double and you can have little damage from that,” he said. Elsewhere in credit markets, robust investor demand for bonds has kept risk premiums relatively tight despite ample supply of newly issued debt, while spreads on junk bonds dropped to their narrowest levels since early 2022. A Bank of America strategist said last week that high-grade bonds are experiencing a “goldilocks scenario” of higher yields, lower interest-rate volatility, fund inflows and “hot, but not too hot US data.”

9finFebruary 21, 2024

We want to welcome a new name in the debt market news, 9fin!

We are also delighted to be featured in their article “CLO hedge funds return over 20% on average in 2023”. It is an excellent summary of the 2023 performance for CLO funds; see the performance table (here). We share with you an extract from this article:

Crystal Funds’ portfolio manager Olivier Gozlan said tightening at the end of the fourth quarter of 2023 from a mark-to-market point of view accounted for around 60% of his funds’ strategies’ performance. CLO resets of large positions in 2023 also contributed, Gozlan added.

“When the war in Ukraine started in 2022, many people thought the crisis would be a matter of weeks but by May/June the market realised it was going to be for a long time,” he said. “There was a wave of new deals in the summer being issued for risk management of the warehouse with debt issued at a large spread and we raised money at the time for this specific opportunity.”

Gozlan says the firm was able to deploy at this efficient entry point, for example investing in single-Bs in the 1,500 DM. “Today spreads are 900bp, so the price effect is material,” he added.

The full article can be found (here).

Leading Fund – BK Opportunities Fund VFebruary 15, 2024

We are delighted that CreditFlux has written an article in the January edition of their newsletter on BK Opportunities Fund V as a leading credit fund for its outstanding return.

You can find the full article (here).

Creditflux CLO Symposium 2023 Panel with Olivier GozlanMay 10, 2023

During the Creditflux CLO Symposium 2023, Olivier Gozlan, portfolio manager at Crystal Fund, participated in the Panel: Would you buy it?

You can access the entire panel discussion here.

Crystal Fund receives Best CLO Fund award in 2023 at CreditFlux Award CeremonyMay 4, 2023

Launch of BK Investment Grade VIIIApril 1, 2023

Crystal Fund is expanding with a new strategy focused on global investment-grade CLO tranches. Up to now, the focus was on junior mezzanine in US and European CLO tranches alongside CLO equity. The extension of investment scope comes from identifying meaningful risk-return opportunities in the single As and triple Bs.

BK Investment Grade VIII will launch at the end of April 2023, giving Crystal Fund the ability to invest from single As down to equity.

Dr Pierre-Olivier Fortin is promoted to the investment committeeMarch 15, 2023

The Crystal Fund keeps developing. The strategy leans toward business growth and responsible investment. As part of this strategy, the investment committee welcomes Dr Pierre-Olivier Fortin to join and bring a new set of expertise to assist the investment decisions.

Signatory of the Principles for Responsible InvestmentMarch 1, 2023

The Crystal Fund seeks to participate in building a more sustainable financial system. We believe the credit market as a whole, and the CLO market in particular, can be sustainable and act as welfare-enhancing.

This is why on March 2023, the crystal fund and all its associated vehicles signed the Principles for Responsible Investment (PRI) to show the Crystal Fund’s commitment to responsible investment.

Launch of BK-7September 15, 2021

CLO Mezz Panel – CLO Summit with Olivier GozlanDecember 9, 2020

Olivier Gozlan, portfolio manager at Crystal Fund, participated in the CLO Mezz Panel – CLO Summit.

Crystal Fund receives Best CLO Fund award in 2019 at CreditFlux Award CeremonyMay 7, 2019

On May 7th, 2019, Olivier Gozlan from Oristan DAC was awarded the prestigious best CLO Fund at the CreditFlux Award Ceremony of the CLO Symposium in London. We have a short video of Olivier Gozlan accepting this award.