|

|

|

|

BK Opportunities

Fund 6

Quarterly Report | 31 March 2022

|

|

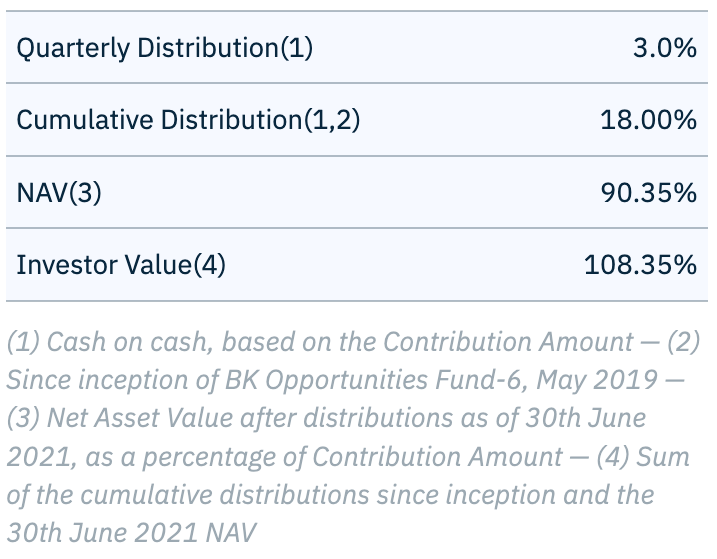

BK Opportunities Fund-6 will make its quarterly distribution to its investors for the 31st March 2022 quarter-end of 3.00% (cash-on-cash, non-annualized) of its Contribution Amount (in USD). Payments will be wired on the 28th of April 2022.

|

Furthermore, the N.A.V. of BK Opportunities Fund-6 as of 31st March 2021 after distribution is 90.35%.

|

|

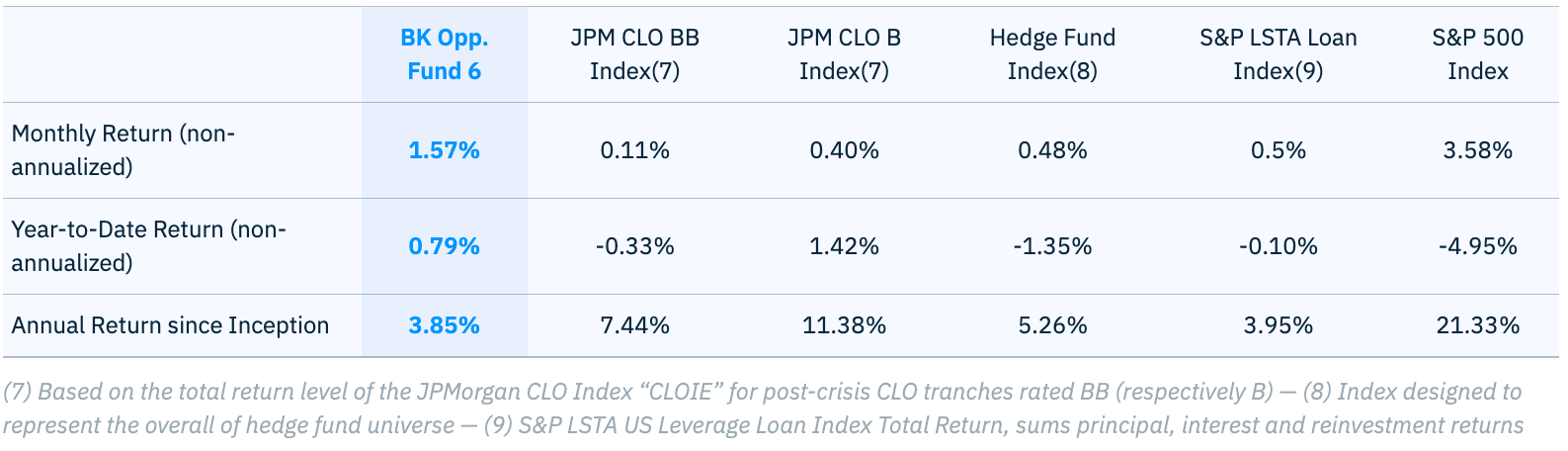

BK Opportunities Fund-6 net performances as of 31st March 2022 are:

|

|

March 2022 Monthly Return (non-annualized): +1.6%

|

|

March 2022 Year-to-Date Return (non-annualized): +0.8%

|

|

March 2022 Annual Return since inception1: +3.8%

|

|

Cumulative Distributions inception/May 20192: 18.0%

|

Cumulative Return since inception/May 2019 (Distributions + NAV gain)1: +8.8%

|

|

(1) Based on the weighted average return of all classes since their respective closing date.

|

|

Market Commentary & Portfolio Overview

|

|

|

|

Ukraine War

|

|

Since February, the war has hung news and business in Ukraine while the world was getting away from the Covid disruption. A widespread international embargo has cut Russia’s economy from most of the world. Many Russian assets are frozen, and many private companies are leaving Russian operations. The two significant impacts on the world economy are shortages in energy, mainly oil and gas, and commodities like Nikel or wheat. Energy shortages have an immediate impact on developed economies, mainly in Europe. On the commodity front, the impact is a more slow burn. The reaction was strong on the U.S. and on the E.U sides. The Biden Administration ordered record oil releases from the strategic reserve and invoked Cold War powers to encourage domestic production of critical minerals. The E.U. is coordinating to immediately reduce its reliance on Russian energy and possibly stop it completely. With no end in sight to the Ukrainian conflict, its impact on the global economy will continue from higher energy prices to a food shortage; Ukraine produced 30% of the worldwide wheat export.

|

|

|

|

|

|

|

Inflation vs The Economy

|

|

The U.S. economy has “gone from being on the mend to on the move,” said President Joe Biden, as a solid March jobs report a strengthened job market. Before the Ukraine conflict, inflation was the central area of concern. While the U.S. is comparatively insulated from the Russia-Ukraine crisis, it fuels more price increases. The U.S. economy looks better than last quarter. Fear of stagflation is overblown as corporate solid balance sheets and recovering service sector activity, while the labour is picking up, should prevent a global recession this year. Fed Chair Jerome Powell has said recently that the Fed would support a more aggressive monetary policy to curb decades-high inflation, including a likely 50-basis-point hike at the next policy meeting in early May. The market remains highly volatile and undecided on its direction.

|

|

|

|

|

|

|

Corporate Markets

|

|

2022 has been volatile from high expectations about moving on from Covid to the war in Ukraine. Corporates still suffer from the covid disorganized supply chain before being impacted by the Ukrain war externalities. This was reflected by the S&P 500 is down 5% year to date in mid-April. On the credit side, fears of higher costs would squeeze corporate profitability and then increase the risk of default can explain the significant dip of the LSTA U.S. Leveraged Loan 100 Index in mid-March. Those fears were lifted when data showed costs were being passed to the customer, and the LSTA index returned to year-end levels. Interestingly defaults are not a driver of return, as the LSTA default rate went down to 0.19% in March from 0.29% in January.

|

|

|

|

|

|

|

CLO Update & activities

|

|

In parallel, CLO tranches secondary trading prices have dropped by several points at the beginning of the Ukrainian crisis, but have stabilized in this context since then. As primary market was subdued, market players with reinvestment capacity have increased participation in secondary activity. As usual in this environment, investment grade tranches showed more consistency in trading than the more mezzanine tranche. This gave rise to trading opportunities. As several positions of BK Opportunities Fund-6 were reset or redeemed (at par) right before the Ukrainian war, we were able to reinvest these proceeds into attractive profiles.

|

|

|

|

|

|

|

BK Opp. Fund 6

Performances

|

|

BK Opportunities Fund‐6 is making a distribution of 3.00% this quarter (wired on 28th April 2022), bringing the total distribution since inception to 18.00% non‐annualized. The annual return since inception is +3.8%, still well below our expectation but our portfolio is well positioned to resist downside while performing in a benign environment. With the current market environment, and despite the robustness of our portfolio, our positions are priced relatively conservatively. As we collect coupons & principal (and distribute or reinvest them) and trade around our positions, the fund’s performance should continue to increase and reach level in‐line with our target.

|

|

|

|

|

|

|

|

Fund’s Summary

|

| Currency |

USD |

| Fund’s Inception |

May 2019 |

| Last Closing |

February 2020 |

| End of Reinvestment Period |

February 2023 |

| Maturity(5) |

February 2025 |

| Distribution |

Quarterly(6) |

| Investment Manager |

Oristan Ireland DAC |

| Administrator |

Apex Funds Services |

| Custodian |

CIBC Bank & Trust |

| Banker |

Northern Trust |

| Counsel |

Dillon Eustace |

| Auditor |

Deloitte |

| Bloomberg Page |

BKOPP6A KY |

|

|

(5) Excluding the possible 2‐year extension

|

|

(6) First quarterly distribution made on 30th September 2020

|

|

|

|

|

|

Fund and Market Performances as of 31 March 2022

|

|

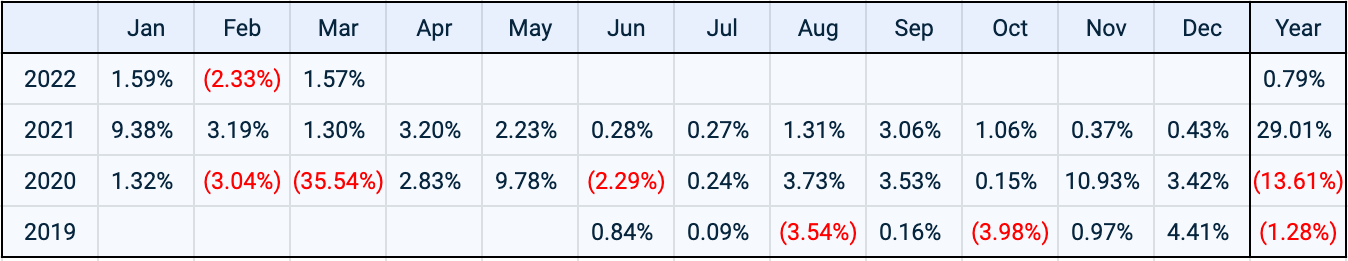

Monthly Performances

|

|

|

|

|

Distribution

|

|

|

|

|

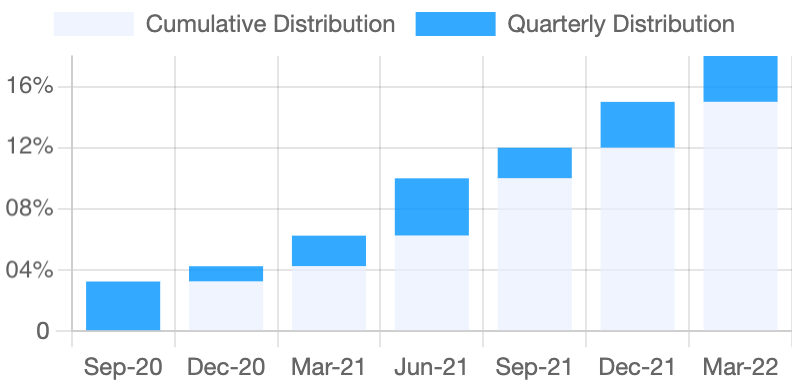

Cumulative and Quarterly Distribution

|

|

|

|

|

|

Portfolio Manager

Olivier Gozlan

|

|

|

|

|

|

|

|

|

|

This is not for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation. The information contained herein is for information only and does not constitute an offer regarding any product. The document has been prepared by Oristan Ireland DAC and the data have not been audited nor verified. Past performance cannot indicate future performance. There is no assurance that the investment objective will be achieved and investment results may vary.

|

|

|

|

|

|

|

|