|

|

|

|

BK Opportunities

Fund 5

Quarterly Report | 31st March 2023

|

|

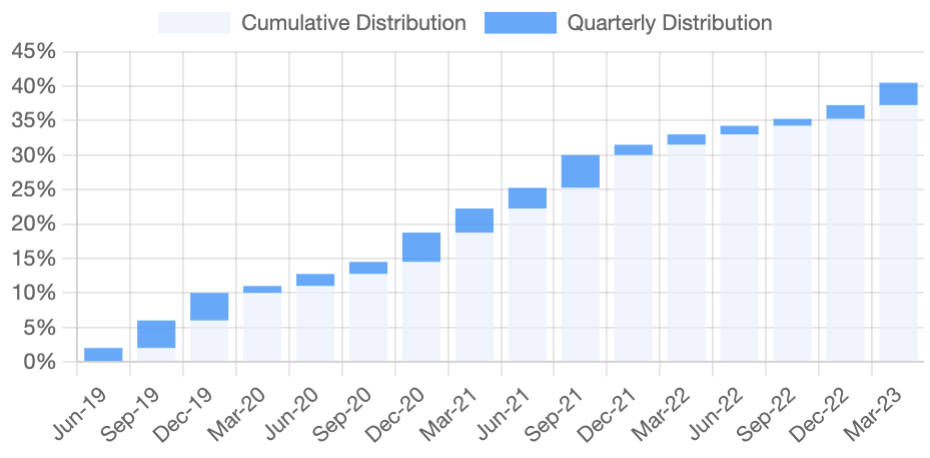

BK Opportunities Fund-5 (Euro) will make its quarterly distribution to its investors for the 31st March 2023 quarter-end of 3.25% (cash on cash, non-annualized) of its capital contribution. Payments will be wired on the 5th of May, 2023.

|

Furthermore, the N.A.V. of BK Opportunities Fund-5 (Euro) as of the 31st of March 2023 after the distribution is 80.63%.

|

|

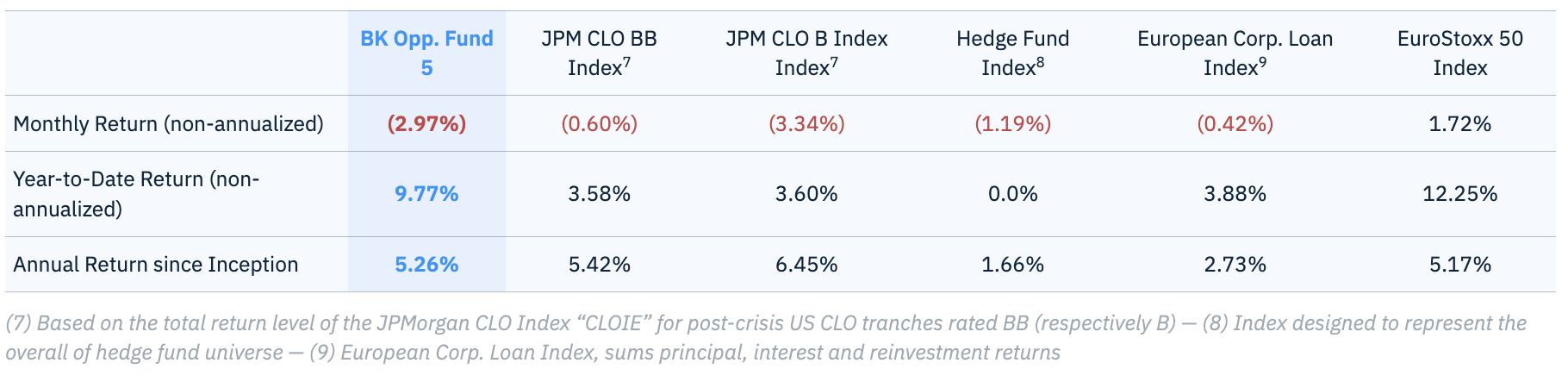

BK Opportunities Fund-5 (Euro) updated performances are:

|

|

March 2023 Monthly Return (non-annualized): -2.97%

|

|

March 2023 Year-to-Date (non-annualized): 9.77%

|

|

March 2023 Annual Return since inception1: +5.26%

|

|

Cumulative Distributions since inception/July 20182: +40.50%

|

|

Cumulative Return since inception/July 20182 (Distributions + NAV gain): +21.13%

|

|

|

(1) Based on the weighted average internal rate of return (“IRR”) of all classes from their respective closing date at their respective entry price

|

|

(2) Based on the number of shares (or the capital contribution) in the fund, i.e. assuming an entry price of €1,000 per share or 100.0%

|

|

Market Commentary & Portfolio Overview

|

|

|

|

|

The demise of Credit Suisse surprised many primarily by its speed and magnitude, reminding many of a previous financial crisis. It was mirrored on the other side of the Atlantic by the similar fate of the Silicon Valley Bank and Signature. Since then, markets and governments have passed those scares, leaving us with a stable situation up until the failure of First Republic Bank, eventually taken over by JP Morgan by early May (post quarter-end).

|

|

|

|

|

|

|

The Economy: ECB Determined on Inflation Containment

|

|

The euro area's headline inflation is decreasing to 6.9% while the core inflation is increasing to 5.7 %. This can be explained by the energy market stabilisation bringing some relief to the headline inflation. In contrast, the underlying core inflation does not react to the ECB's action to bring it back under control, as we are still far from the mandated 2% limit. The ECB’s deposit rate — currently 3.00% to 3.75%- is likely to increase by 25 and 50 basis points in May. Most of the discussions are about the speed and extent of future hikes. Madis Muller, who heads Estonia’s central bank, said that the next moves will be based on a broad assessment of the economy “There’s no reason for us to assume at this point that the banking turmoil in the US and Switzerland is changing the outlook for the euro area.” While financial-sector tensions push for a slowdown, they are unlikely to throw the ECB off course.

|

|

|

|

|

|

Corporate Markets: Strong Start of the Year

|

|

The Dax is up 11.6%, and the CAC 40 is up 14.12% since the beginning of the year, reflecting a healthy growth of the euro market. One factor that played a role is the end of the Chinese zero covid policy allowing the Chinese economy to restart. LVMH, one of the largest capitalisations in the CAC 40, reported soaring Chinese sales as shoppers emerging from lockdowns splurged on luxury items. That propelled it into the ranks of the ten largest global conglomerates. This performance is notable as it happened at the same time as a significant interest rate increase. Inflation and rates are the two primary potential sources of concern for the future of European corporates as a reaction to rates might be felt in the near future.

|

|

|

|

Corporate Loans: Stable Outlook

|

|

The European trailing 12-month Leveraged Loan Default Rate by amount was 1.5% in March following S&P ELLI. We are still very much below industry averages. The balance sheet of European corporate still stays strong, and following the distress ratio, credit risk has stabilised. Concerns are switching from inflation to growth so that we can expect some activity on spread and volatility hindering credit return, especially the lower-rated segment. The effect favours the higher-quality segment with a more appealing risk/reward. We expect more opportunities in the IG area than in high yield.

|

|

|

|

CLO Market: Strong New Issuance Activity

|

|

|

|

With ten new European CLOs hitting €3.8 billion in February, the new issuance activity has been vigorous following a reasonably quiet January that saw only three issues have been priced. The tightening of liability spreads helped this substantial activity in the primary market. The spread tightening could be seen across the capital structure for recently priced European CLOs.

|

|

|

|

BK Opp. Fund 5: Performances

|

|

This quarter, BK Opportunities Fund-5 is making a distribution of 3.25% to its investors. Payments will be wired on or around the 5th of May, 2023—the total distribution since inception at 40.50% of the Capital Contribution. The cumulative return as of 31st March 2023, which blends distributions and NAV profits, is 21.1 % or 5.3% on an annual basis. In the current context, our positions are priced (by brokers and dealers) conservatively, but our anticipations for the fund’s overall return are unchanged. The fund is now in its amortisation mode, so from now on, all distributions and proceeds will be distributed, and we also focus on monetising the positions.

|

|

|

|

|

|

|

Fund and Market Performances as of 31st March 2023

|

|

|

|

|

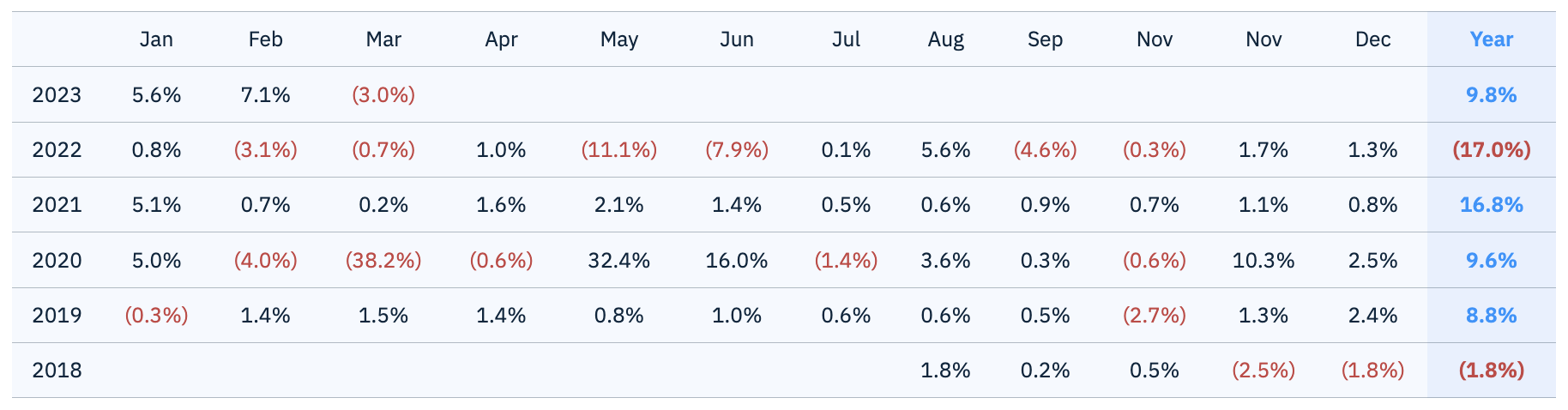

Monthly Performances

|

|

|

|

Quarterly Distribution

|

|

|

|

|

Cumulative and Quarterly Distribution

|

|

|

|

|

|

Fund’s Summary

|

| Currency |

EUR |

| Fund’s Inception |

August 2018 |

| Last Closing |

October 2019 |

| Maturity5 |

October 2024 |

| Distribution |

Quarterly6 |

| Investment Manager |

Oristan Ireland DAC |

| Administrator |

Apex Funds Services |

| Custodian |

CIBC Bank & Trust |

| Counsel |

Dillon Eustace |

| Auditor |

Deloitte |

| Bloomberg Page |

BKOPP5A KY |

|

|

(5) Excluding the possible 2‐year extension

|

|

(6) First quarterly distribution made on 30th June 2019

|

|

|

Portfolio Manager

Olivier Gozlan

|

|

|

|

|

|

|

|

|

|

This is not for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation. The information contained herein is for information only and does not constitute an offer regarding any product. The document has been prepared by Oristan Ireland DAC and the data have not been audited nor verified. Past performance cannot indicate future performance. There is no assurance that the investment objective will be achieved and investment results may vary.

|

|

|

|

|

|

|

|

|